RA’s Daily Russia News Blast – December 2, 2021

Today in Russia: Blinken and Lavrov meet while sparring over Ukraine continues; Beware high impact sanctions!; Lukashenko says “joint union currency” will be a ruble…but which ruble?; Central African Republic: Russia’s latest area of influence? Novatek to ship LNG to China via Japan to tap into growing small-end user market

Let’s talk. Foreign Minister Sergei Lavrov and Secretary of State Antony Blinken are set to meet today in Stockholm. The talks are likely to be frosty, with Blinken declaring the day of the meeting that NATO allies had an “unwavering commitment” to Ukraine’s sovereignty and repeating concerns about Russia’s apparent build-up of troops on the border. Ukraine’s Foreign Minister Dmytro Kuleba tweeted that it was working with NATO countries on a “comprehensive deterrence package including severe economic sanctions” to deter against Russian aggression. The meeting also comes on the heels of the arrest of alleged Ukranian spies in Russia by the FSB.

High Impact! Secretary of State Blinken warned of “high impact” sanctions if Russia attacks Ukraine. At a meeting with NATO foreign ministers in Riga, Blinken said, “We’re deeply concerned by evidence that Russia has made plans for significant aggressive moves against Ukraine, plans include efforts to destabilise Ukraine from within as well as large scale military operations.”

Let’s use a ruble. Alexander Lukashenko, Belarus’ strongman president declared that when Russia and Belarus adopt a unified currency, it will be called the ruble. But Lukashenko also said agreements signed in the 1990s with Russia about this eventuality “imply the creation of a third currency“: “Here is the Russian ruble. Everyone wants a single currency – although when Yeltsin and I signed the agreement, we meant that it would be neither the Belarusian nor the Russian ruble, but some other, third currency. But since we have a ruble, and you have a ruble, why should we invent it? …Yes, it will be a ruble.”

Lukashenko added that there are no limits to how much Belarus and Russia could integrate: “It sounds philosophical, but that’s what it is. There are no limits.” It is difficult to fathom now that Belarus has become something of a pariah state in the eyes of the West, but it was not long ago when Lukashenko was publicly trying to distance himself and his country from Russia, even arresting what he claimed to be Russian spies in July 2020.

Russian in the curriculum in…CAR? The Central African Republic has made Russian an obligatory course for university students. It comes as the secretive private military company Wagner Group has become increasingly involved in securing CAR. While Western media has declared Wagner a “destructive” force and the UN has called on CAR to stop using Wagner, it has apparently had some success in securing the country. Wagner has also apparently ruffled some feathers in the Russian foreign ministry, with some reports suggesting that “Wagner has been courting publicity in a way that is jarring with the reserve of Russian diplomats” in Africa.

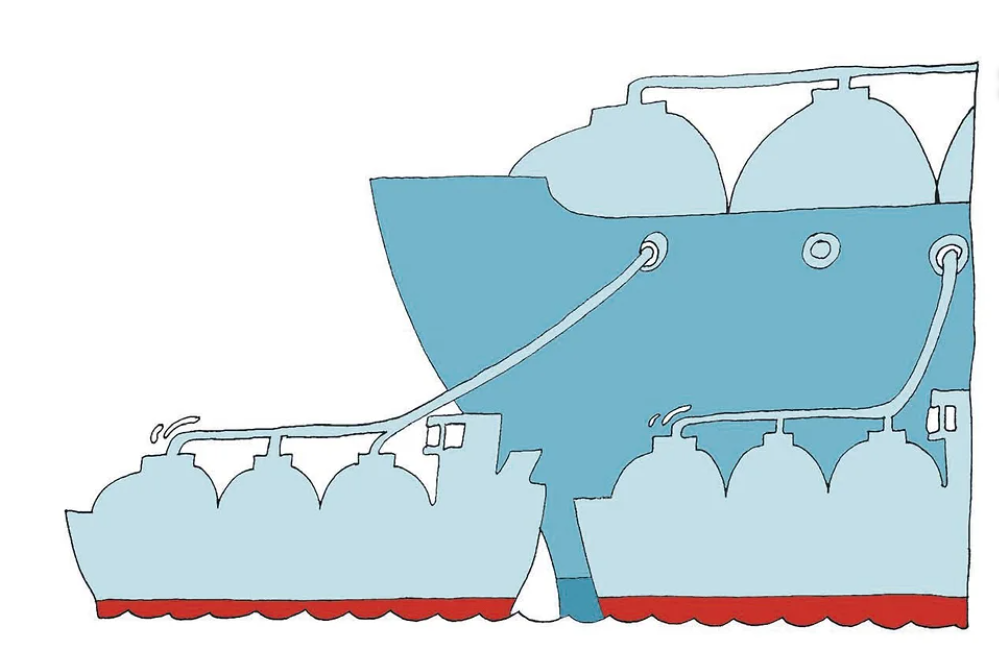

New markets. Novatek plans to expand its LNG business in China by focusing on small-end users, Kommersant reported. The scheme will involve the use of massive LNG tankers which will transport Russian LNG to Japan’s Hibiki LNG terminal on the southern island of Kyushu, where the LNG will be transferred to smaller vessels which will then deliver LNG to Hangzhou in the prosperous Zhejiang province in China. The scheme, which involves agreements with Japan’s Saibu Gas as well as a purchasing agreement from China’s Zhejiang Hangjiaxin Clean Energy Company, will begin in 2024 and involve 140,000 tons per year. Kommersant speculated that the gas would come from Novatek’s Arctic LNG-2 project, but Novatek declined to confirm this.

Novatek’s new LNG project could be a harbinger of things to come. China has traditionally been a relatively closed market for LNG imports, with the large state-owned energy giants controlling most LNG terminals and therefore imports. As the sector is being liberalized in China (and Beijing focuses on greener energy over coal), there is an “opportunity for LNG suppliers to conclude contracts with second-tier consumers, whose share in the total consumption in the country’s domestic market is increasing.” There is also increasing competition between Russia, Qatar, and the USA for these new markets.

PHOTO: Novatek has a new plan to increase its market presence in China’s LNG market, requiring the transfer of LNG from massive tankers in Japan onto smaller tankers which will bring LNG directly to small-end users (Viktor Chumaev/Kommersant).